Miners make the use of cryptocurrency possible by providing the infrastructure of the necessary hardware that supports end user activity. In return, miners earn Block Rewards for validating transactions. Cryptocurrencies make use of different types of hardware, namely CPU, GPU and Hard Drive space and thus are able to provide services such as transferring value, messaging or encrypted document storage.

Lightweight mining software has emerged that allows anyone to use their spare resources to support a network and earn rewards that reflect their dedicated computing power. It is most impactful however to set up a dedicated rig (a computer whose sole purpose is to mine cryptocurrency).

When the miner “discovers” a block it simply means their computer gets to add the next block to the Distributed Ledger (the coin’s blockchain) by solving the next transaction across that network. Part of a miner’s transaction validation duties is to send a signal letting the public know that a particular transfer occurred, without disclosing all contents of that transfer. This allows all nodes (wallet holders and miners) to have the current state of the distributed ledger at all times. This is a necessary aspect of cryptocurrency as this guarantees that any new transactions in the ledger are in fact unique and authentic.

What is Cryptocurrency Mining?

What Cryptocurrency Should I Mine

When choosing which coin to mine, there are plenty of resources, like https://whattomine.com that can help you get started. You must look at factors like the total network size, block reward, and conversion rates of native fiat, among others in order to decide which coin may be profitable to mine now or speculatively so, for the future.

The Network Size is the total computational resources verifying transactions across that network. It is indicated by the Net MegaHash/GH/TH of CPUs and GPUs currently performing proof of work and Net GigaBytes/TB/PB available for Proof of Capacity in distributed storage networks. The total amount of computing resources on a network provide a bandwidth to support user activity worldwide and can mean two things for miners:

- As the network size gets larger the same machine will run longer between block rewards because your node becomes proportionately less likely to be the one that verifies the next transaction.

- A high NetHash or NetTB is an indicator of user adoption and support for activity of the currency.

A miner can use the network size (along with other factors) to speculate their return on investment long term retention of the coin’s value. After getting started, the most effective miners maximize their earnings by keeping a close eye on forums for news, network operations changes as well as tips for hardware-specific tweaks.

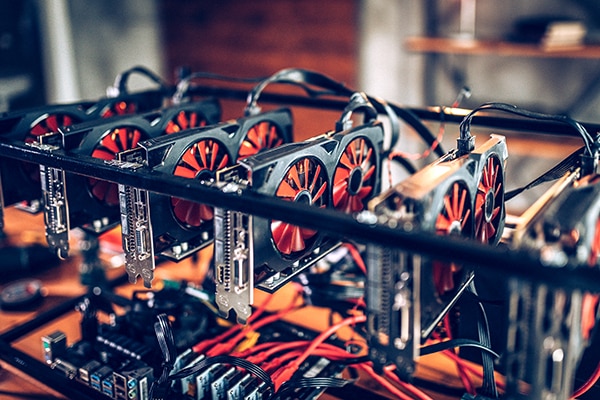

Crypto Mining Rigs (Hardware)

Miners invest in hardware and ongoing electricity costs and are responsible for the uptime of their machines. To start mining you must determine the coin you want to mine and the hardware that the coin’s network requires. You’ll want to account for these basics when choosing your mining rig/equipment:

- Hardware performance described by MH/s (million hashes per second) or GB/TB space;

- Cost of hardware is usually (but not always) reflective of the quality and performance. New miners may find the cost of equipment fluctuating due to a rise in global demand for components;

- Power consumption of each component to determine total operating Watt load of your rig(s) and to calculate your electrical operating costs. If you plan on making a significant investment in hardware you may want to consult an electrician to understand your outlet(s) and circuit breaker ratings. You must ensure you operate within your power limits to not create a fire hazard or consistently trip your breakers in your home or place of business.

- Heat generated is also determined by calculating the total Watt load of your system. A rule of thumb is that your rig(s) will output the same amount of heat as an electric heater of the same Wattage rating as the total consumption of your machine(s).

- Hardware depreciation is hard to estimate but should be accounted for with the price-to-quality of components as well as your plan to manage heat and dust. Miners should also be careful to understand overclocking practices with their specific hardware in order to balance the risk of hardware failure versus gains in performance.

Miner Software

Cryptocurrency miners use software issued by a currency’s developers to point their computer resources at the specific currency network. The software puts the hardware to work in a way that enables the services of that currency. Once you assemble the rig and download the coin’s mining program, you open up your resources to the network and get rewarded when you verify transfers or hold bits of encrypted documents.

Mining Wallet

You configure your rig’s software so that rewards for your mining efforts are deposited into your wallet. You are responsible for that wallet’s security and ensuring that your miner is indeed working for you and not somebody else unless you are donating your work or are mining for a pool and expect periodic payouts.

Pool Mining

You have a choice to mine as an individual or to join a pool of miners on the same currency network. By merging resources and essentially acting as one large miner, members of a pool increase their chances of verifying new transactions and stabilizing their returns.

Joining a pool means pointing your resources at the same yield wallet as other pool members. The pool’s administrators are responsible for security of the yield wallet and distribution of the yields according to member resource contributions. Pool mining requires additional caution and monitoring on your behalf to make sure the pool’s administrators behave fairly and consistently with their distributions.

Bitcoin Mining Rewards Calculator

Powered by CryptoRivalEthereum Mining Rewards Calculator

Powered by CryptoRivalConclusion

To best hedge your profitability and equipment lifespan, you should monitor global and local performance aspects such as the currency’s block reward and your system’s temperatures just to name a few variables. You must stay up to date with the currency news to gauge when to sell or hold your mined yields and make educated decisions on when to switch your rig’s resources to another pool or currency altogether to maximize your potential rewards.